Loan Payoff Calculator

Calculate exactly how much money you’ll save and how many years you can cut off your loan by making extra payments. Free, accurate, and instant results.

Loan Details

Extra Payment Options

Results

Payment Breakdown

| # | Payment | Principal | Interest | Balance |

|---|

Why Every Borrower Needs an Early Loan Repayment Calculator

Debt can feel like running on a financial treadmill: you’re working hard, but your balance barely moves. That slow progress is due to something called interest accrual, which is heavily front-loaded on most loans.

Our Loan Payoff Calculator is built to give you the advantage. It’s not just an estimate; it’s a precise financial plan that uses your exact extra payments to recalculate your loan’s future. It instantly shows you the two things you care about most:

- The exact date you will be free of the debt.

- The exact amount of interest money you get to keep.

Stop paying thousands more than you need to. Start seeing your debt-free date accelerate with every calculation.

Calculate Payoff for Any Type of Loan

This calculator works for all types of loans with fixed interest rates:

Mortgage Loans

Whether you have a 15-year or 30-year mortgage, see how extra payments can help you own your home years earlier. Even an extra $100 per month can save you over $30,000 in interest on a typical mortgage.

Auto Loans

Car loans usually have shorter terms, but the interest still adds up. Calculate how much faster you can own your vehicle free and clear by rounding up your monthly payment.

Student Loans

Student loan debt can follow you for decades. Use this calculator to create a realistic payoff plan and see when you can finally be student-debt-free.

Personal Loans

From debt consolidation to home improvement loans, find out how quickly you can eliminate high-interest personal debt with strategic extra payments.

See the Power of Extra Payments in Action

Meet Henry: He has a $300,000 mortgage at 6.5% interest for 30 years.

His original plan:

Henry decides to pay an extra $250 per month:

That extra $250 per month returned over $124,000 to Henry’s pocket. And he’ll be mortgage-free almost a decade earlier. Your numbers might be even better. Try the calculator above with your loan details to find out.

Key Benefits of Using Our Early Loan Payoff Calculator

Quantify Your Freedom

See the precise dollar amount of interest you will save over the life of the loan.

Find Your Finish Line

Calculate your exact new payoff date, eliminating months—or even years—from your current term.

Strategy Comparison

Test different payment strategies (monthly, bi-weekly, or lump sum) to find the most efficient path for your budget.

Visualize the Impact

Use the Chart View to see the principal-to-interest ratio change dramatically with extra payments.

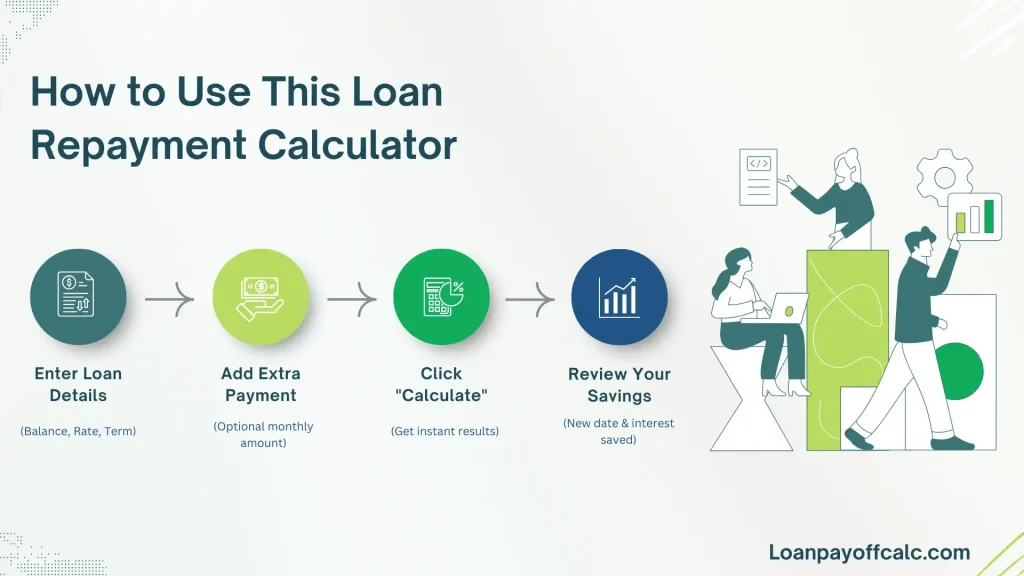

How to Use This Loan Repayment Calculator

Our goal is to make planning your financial freedom easy. The calculator is intuitive, but follow these three steps for the most accurate and powerful early loan repayment results.

Step 1: Input Your Loan’s Current Details

The first step is to tell the calculator where you are right now. You can input values by typing them directly or by using the smooth sliders for quick adjustments.

Field | What to Enter | Why It’s Important |

|---|---|---|

Loan Balance | The total principal amount you still owe today. | This is the starting line for all calculations. Do not include previous interest. |

Interest Rate (APR) | The annual percentage rate for your loan (e.g., 6.5). | This defines the cost of borrowing and is crucial for accurate interest savings. |

Loan Term (Years) | The original length of your loan when you first signed the documents (e.g., 30 for a standard mortgage). | This establishes the original timeline you are trying to beat. |

Step 2: Set Your Extra Payment Goal

This is where you plan your attack on the debt. Use the toggle switch to activate the extra payment fields.

- Activate the Toggle: Turn on the “Add Extra Payment” switch.

- Choose Frequency: Select how often you want to apply the extra amount:

- Monthly: Best for consistent, small boosts (e.g., $100 every month).

- Bi-Weekly: Ideal for modeling the “13th payment” strategy.

- Yearly: Perfect for modeling annual bonuses or tax refunds.

- Enter the Amount: Input the dollar amount you plan to pay extra based on the frequency you chose.

Step 3: Analyze Your Results

After entering your details, the results will update instantly in the right panel. Pay special attention to the three tabs at the bottom: Comparison, Chart View, and Schedule for a complete picture of your accelerated loan repayment plan.

Calculator Face-Off: Ours vs. The Bank’s

It’s easy to assume all financial calculators are the same, but they are built for fundamentally different purposes. Our Loan Payoff Calculator is built for acceleration and savings, while a typical bank’s tool is built for compliance and minimum payment.

Feature | Our Loan Payoff Calculator | Typical Bank Calculator |

|---|---|---|

Primary Goal | To reduce your loan term and maximize interest savings. | To determine your minimum required monthly payment. |

Extra Payments | Yes. Allows modeling of monthly, bi-weekly, and yearly extra payments. | No, or extremely limited. Usually requires manual, separate calculation. |

Result Metric | Time Saved (in months/years) and Total Interest Eliminated. | Final monthly payment amount |

Payoff Date | Precise New Payoff Date. Shows the exact accelerated finish line. | Shows the original scheduled payoff date only. |

Focus | Borrower Empowerment and finding the most efficient path to debt freedom. | Bank Compliance and minimizing the bank’s workload. |

The Takeaway

A bank calculator tells you what you have to pay. Our calculator shows you the powerful results of what you can pay. If your goal is to achieve early loan repayment, the only calculation that matters is the one that includes your extra payment strategy.

Understanding the Engine: How Extra Payments Slash Your Term

To conquer a loan, you must understand the relationship between Principal (the money you owe) and Interest (the money the bank charges you).

The Power of Principal Reduction

A standard monthly payment is designed to slowly pay down the principal while heavily covering the accrued interest.

The game-changer happens when you make an extra payment: You specify this money goes 100% to the Principal.

By reducing the principal early, you immediately shrink the base amount that your interest rate is applied to for all future months. This creates a powerful snowball effect: you save interest, which means more of your next standard payment goes to principal, which saves even more interest, and so on.

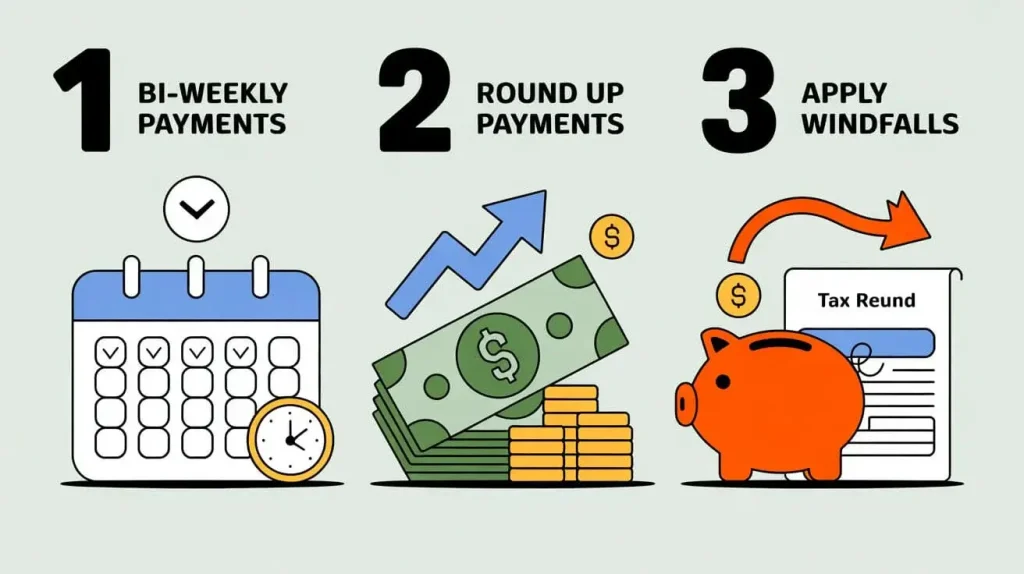

Expert Strategies for Early Loan Repayment

The Early Loan Payoff Calculator allows you to model three powerful strategies to see which one delivers the biggest payoff for your budget.

Strategy 1: The Bi-Weekly Payment Method

This is the easiest way to make one extra payment per year without feeling it.

Instead of paying once per month, split your payment in half and pay every two weeks. Since there are 52 weeks in a year, you’ll make 26 half-payments (which equals 13 full payments instead of 12).

This simple change can cut 4-7 years off a 30-year mortgage and save tens of thousands in interest.

How to use the calculator: Select “Bi-Weekly” frequency and enter half your monthly payment amount.

Strategy 2: Round Up Your Monthly Payment

If your mortgage payment is $1,847, round it up to $2,000. That extra $153 goes directly to principal every month.

This strategy is perfect if you want consistent progress without a big budget change. Most people don’t even notice the difference in their monthly budget.

How to use the calculator: Select “Monthly” frequency and enter the difference between your actual payment and your rounded-up payment.

Strategy 3: Apply Windfalls to Your Loan

Got a tax refund? Work bonus? Birthday money? Put it toward your loan principal.

Even one or two large payments per year can shave years off your loan term. A single $5,000 payment on a mortgage can save you $15,000-$20,000 in future interest.

How to use the calculator: Select “Yearly” frequency and enter your expected windfall amount.

What Happens When You Pay Off Your Loan Early?

You Save Serious Money

The biggest benefit is obvious—you keep the money that would have gone to interest. We’re talking thousands or even hundreds of thousands of dollars, depending on your loan size.

You Gain Financial Freedom Faster

Imagine not having a mortgage payment, car payment, or student loan payment. That money goes back in your pocket every month. You can save more, invest more, or simply stress less about bills.

You Build Equity Faster

For mortgages and auto loans, paying extra builds your equity much faster. This means you own more of your asset sooner, which helps if you need to sell or refinance.

You Improve Your Financial Security

Less debt means less risk. If you lose your job or face unexpected expenses, having fewer or smaller monthly obligations gives you breathing room.

You Reduce Stress

Debt creates stress. Every extra payment is one step closer to complete freedom from that monthly obligation. Many people describe finally paying off a loan as one of the best feelings in the world.

How to Actually Stick to Your Payoff Plan

Start Small and Build Up

Don’t commit to huge extra payments you can’t sustain. Start with $25 or $50 extra per month. As you see progress, you’ll get motivated to increase it.

Automate Your Extra Payments

Set up automatic payments so you don’t have to think about it. If your lender allows it, automate both your regular payment and your extra payment.

Track Your Progress

Use this calculator every few months to see how far you’ve come. Watching your payoff date get closer is incredibly motivating.

Treat Windfalls as Bonus Payments

Tax refunds, work bonuses, gifts—consider putting at least half toward your loan. You’ll barely miss the money, but your future self will thank you.

Don’t Forget Your Emergency Fund

Before making aggressive extra payments, make sure you have 3-6 months of expenses saved. You don’t want to drain your savings and then need to borrow money in an emergency.

Celebrate Milestones

When you hit $10,000 paid off, or cut your balance in half, or eliminate a year from your term—celebrate! Small rewards keep you motivated for the long haul.

Frequently Asked Questions About Loan Repayment

Ready to Claim Your Debt-Free Date?

The math doesn’t lie. Every dollar you dedicate to your principal is an investment that pays guaranteed returns by eliminating future interest. Our Loan Payoff Calculator gives you the clarity and motivation you need to succeed.

Enter your loan details now and discover your new debt-free date!